PACE Awards go to innovations from Dana, Valeo, Yazaki and 10 others

2024 Automotive News PACE Award winners ranged from an advancement in lidar technology to a potentially better way to paint cars in the factory.

2024 Automotive News PACE Award winners ranged from an advancement in lidar technology to a potentially better way to paint cars in the factory.

U.S. authorities have issued a new mandate that will require carmakers to install automatic emergency braking systems on new vehicles beginning in 2029. Regulators expect the rule to save 360 lives a year.

Asbury Automotive Group said it entered Q2 with $243 million in assets for sale — including 10 dealerships — after selling a Jim Koons Lexus site in Delaware to MileOne Autogroup in March.

Employees at five Disney Springs restaurants announced Monday they are working with union organizers, speaking out about what they consider to be unfair wages and poor working conditions.

Workers at nonunion restaurants operated by the Patina Restaurant Group said they make less than unionized Disney employees doing the same jobs just a two-minute walk away.

The unionization push involves more than 300 restaurant workers at Morimoto Asia, The Edison, Maria and Enzo’s, Enzo’s Hideaway and Pizza Ponte. Those eateries are in the Disney Springs entertainment complex but are run by a third-party restaurant chain, not The Walt Disney Co.

Patina Restaurant Group is owned by Delaware North, one of the largest privately owned hospitality and entertainment companies in the world.

“There is a second-class of restaurant workers at Delaware North restaurants at Disney Springs. … Many of them make lower wages than peers at Disney,” said Jeremy Haicken, president of Unite Here Local 737, which represents 18,000 food, beverage and housekeeping workers at Disney World. “Many of them say they are considered part-time in the Delaware North system, even though they report working four, five, six or more days a week.”

By Elizabeth Renter | NerdWallet

High school graduates — and their parents — have a lot on their minds this spring, not the least of which is paying for college. Amid financial aid delays stretching months beyond what’s typical, some students are feeling pressured to make college decisions without even knowing how much they’ll be required to pay.

Still, one thing is clear: Students funding their college career with student loans could be paying for years to come. And if a student depends on loans to cover every year of their undergraduate career, they could end up owing about $37,000 when they graduate.

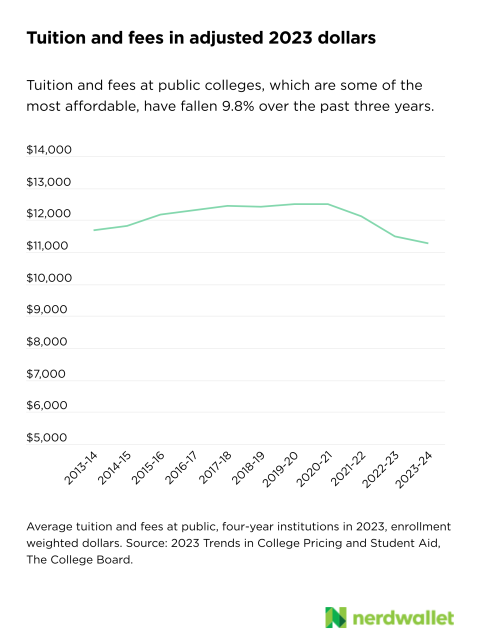

If there is good news for new college students, it’s that growth in the cost of higher education has slowed and even decreased modestly in recent years. The money spent on tuition and fees at public, four-year institutions goes further now than 10 years ago and has fallen 9.8% in just the past three years, according to data from The College Board.

However, this drop doesn’t mean higher education is affordable. On average, full-time undergraduates took out about $6,990 in student loans in the 2020-21 school year, the last year for which that data is available from the National Center for Education Statistics. Based on that figure, and a modest assumed growth rate, a NerdWallet analysis estimates a student depending wholly on loans could amass about $36,700 in student loan debt in a five-year bachelor’s degree pursuit.